The RBI Payment Aggregator Pentesting has now been compulsory for fintech firms in India. Thus, it is a serious compliance need. Besides, on September 15, 2025, the Reserve Bank of India issued new regulations. Also, these recommendations enhance the digital payment ecosystem in India. The deadline of December 31, 2025, is approaching. As a result, payment aggregators have to operate on the spot. Moreover, they should conduct thorough security testing. This paper will tell you everything you need to know about RBI Payment Aggregator compliance and pentesting requirements.

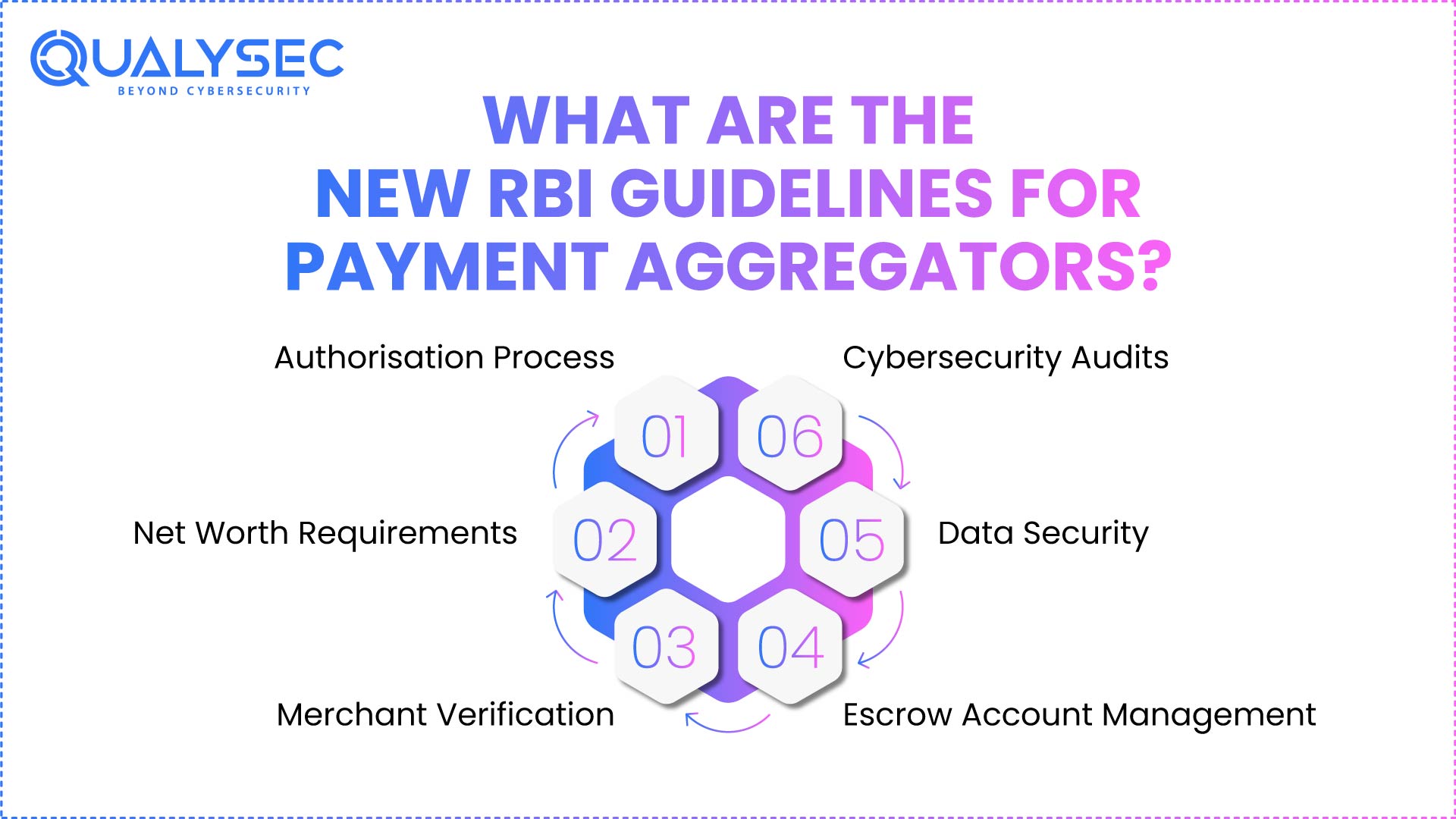

What Are the New RBI Guidelines for Payment Aggregators?

The RBI has come up with stringent rules for all payment aggregators within India. This is applicable to online, offline, and cross-border payment facilitators. As a result, the RBI cybersecurity regulatory framework has been expanded. The regulations are equally applicable to non-bank and banks. In addition, these guidelines revolve around some strategic areas.

First, these principles apply to online and offline payment aggregators. Second, they include cross-border payment services as well. There are also very strong security requirements in the framework. The guidelines require that the non-bank payment aggregators have to prove a net worth of ₹15 crore when they apply, and the amount is increased to ₹25 crore in the third financial year. These capital requirements are for financial stability.

Key Compliance Areas

The regulations are concerned with various areas of compliance. Thus, payment aggregators have to be ready holistically. The following are the key requirements:

- Authorisation Process: All non-bank entities must apply for RBI authorisation by December 31, 2025

- Net Worth Requirements: Minimum ₹15 crore at the application stage

- Merchant Verification: Mandatory physical verification for online merchants

- Escrow Account Management: Strict rules for handling customer funds

- Data Security: Only card issuers may store card data, and tokenisation has become mandatory

- Cybersecurity Audits: Annual CERT-In cybersecurity assessments required

In addition, there are merchant categories introduced by the RBI. As a result, there are various levels of verification in accordance with the size of the business. Moreover, this strategy gives a balance between security and ease of doing business.

The regulations of the RBI Payment Aggregator pentesting have changed forever. The RBI has given detailed Master Directions on September 15, 2025, first. Besides, this framework brings together all the previous regulations. It also substitutes the 2020 and 2021 guidelines. Thus, aggregators of payment now possess a single set of compliance regulations.

Understanding the Three Payment Aggregator Categories

The new directions identify three different categories. All categories are used in various payment requirements. In addition, they both come with certain compliance requirements. The knowledge of this difference is thus significant.

1. PA-Online (PA-O)

PA-Online is an e-commerce transactional company. These are digital payment processing aggregators. Moreover, they allow paying remotely. Also, they should adhere to the highest data security criteria. RBI guidelines for payment aggregators offer a lot of information regarding online business.

2. PA-Physical (PA-P)

PA-Physical deals with transactions on a face-to-face basis. In addition, they process the payments of POS devices. Also, they process QR code transactions. These used to work on an unregulated basis. Nevertheless, they need complete RBI permission at this time. This means that compliance is required by more than 70,000 POS operators.

3. PA-Cross Border (PA-CB)

PA-Cross Border is used to conduct international transactions. Besides, they cover both internal and external payments. Also, they have to be in line with the FEMA regulations. The upper limit of the transaction is ₹25 lakh. In addition to this, there are authorised dealer banks through which payments should pass.

Read the complete guide on payment gateway security

Key Changes from Previous Guidelines

The Master Direction 2025 has been highly improved. Hence, it becomes essential to know these changes. In addition, these revisions deal with the new risks.

| Aspect | Old Guidelines (2020) | New Master Direction (2025) |

| Scope | Only online payment aggregators | Covers PA-O, PA-P, and PA-CB operations |

| Net Worth | ₹15 crore requirement only | ₹15 crore at application; ₹25 crore within three years |

| Merchant KYC | Could skip if the merchant had bank KYC | Mandatory CDD for all merchants using CKYCR |

| FIU Registration | Not explicitly required | Mandatory FIU-IND registration required |

| Compliance Timeline | Various timelines | Unified deadline: December 31, 2025 |

Capital and Authorization Requirements

Non-bank institutions are supposed to satisfy capital requirements. To begin with, they require a ₹15 crore net worth at application time. In addition, this should go to ₹25 crore. Moreover, it takes place over the three financial years. Thus, such thresholds guarantee financial stability.

Banks can proceed with offering the service of aggregators. They do not, however, require separate authorisation. This, in turn, produces alternative compliance directions. In addition, these requirements are elucidated in the RBI press release.

Schedule your free compliance consultation with Qualysec today to understand your specific requirements.

Speak directly with Qualysec’s certified professionals to identify vulnerabilities before attackers do.

Why Is Cybersecurity Pentesting Mandatory for Payment Aggregators?

There are growing rates of cybersecurity threats in India. As such, payment aggregators are exposed to high risks. Besides, they deal with financial information that is sensitive daily. Also, they handle millions of transactions. Therefore, they become the best victims of cybercriminals.

The international cyber threat environment has become more advanced. Cyber attacks are reported to have been the highest in the financial services sector. Moreover, breach of data may cost millions in damages. As such, security testing has been mandated by the RBI.

Read the complete guide on cybersecurity in the banking sector

Understanding Penetration Testing Requirements

Pentesting, or rather penetration testing, is a simulation of actual cyber attacks. Furthermore, it also detects vulnerabilities, and hackers do not take advantage. It also evaluates various levels of security. It involves many important aspects:

- Infrastructure Assessment: Testing network security and server configurations

- Application Security: Examining payment processing systems for weaknesses

- API Security: Verifying integration points remain secure

- Data Protection: Ensuring sensitive information stays encrypted

- Compliance Verification: Confirming PCI-DSS standards are met

Furthermore, pentesting must follow recognized methodologies. Additionally, it should cover both internal and external threats. Therefore, comprehensive testing becomes essential.

Annual information systems and cybersecurity audit reports are required to be obtained by payment aggregators. Additionally, such audits ensure that they observe adherence to RBI guidelines. Also, they determine possible security gaps. Hacking pentesting, hence, provides continuous protection.

Cyber Threat Statistics in India

There has been an escalation of cyber attacks on financial institutions in India. In addition, payment systems have turned out to be commonly targeted. Also, the ransomware attacks have been on the rise. Consequently, preventative security is of paramount importance. The threat landscape is something to keep an eye on. Moreover, novel attack vectors are created on a regular basis.

Download our comprehensive pentesting guide to understand best practices.

Get a Free Sample Pentest Report

What Are the Consequences of Non-Compliance with the December 31, 2025, Deadline?

The impact of the deadline of December 31, 2025, is grave. Thus, payment aggregators have to act as soon as possible. Besides, non-compliance is severely punished. Moreover, the business processes may be brought to a close.

By December 31, 2025, a non-bank payment aggregator is required to stop operations if they are not approved by February 28, 2026. More so, unauthorized operation comes with fines. Also, the lawsuits are unavoidable. Thus, the timely compliance is not negotiable.

Financial and Operational Impact

Lack of compliance has several impacts on business. To start with, businesses are punished by the authorities. Second, they lose business alliances. Third, there is no customer confidence. In addition, reputational losses are long-term.

| Consequence Type | Impact | Timeline |

| Authorization Denial | Must wind down operations | By February 28, 2026 |

| Financial Penalties | Fines and legal costs | Immediate |

| Merchant Loss | Cannot onboard new merchants | December 31, 2025 onwards |

| Escrow Account Closure | All accounts must be closed | October 31, 2025 |

| Reputational Damage | Loss of market credibility | Long-term |

| Legal Action | Regulatory proceedings | Ongoing |

Also, the merchants that are in place need to be re-authenticated. Also, the processing of transactions can be stopped. As such, the financial effect of the business is significant. In addition, non-compliance recovery is time-consuming in terms of resources.

Steps to Ensure Compliance

There should be a systematic plan that payment aggregators should follow. To begin with, perform a gap analysis with RBI requirements. Second, install the required security controls. Third, hire qualified pentesting companies. Furthermore, ensure detailed documentation.

Furthermore, set up a compliance schedule. In addition, delegate distinct duties. Thus, success is guaranteed by systematic preparation. Also, frequent checks are used to keep the compliance levels.

Talk with our compliance experts now to create your compliance roadmap.

Why Is Qualysec Your Trusted Partner for RBI Payment Aggregator Pentesting?

The security requirements laid by the RBI are very stringent, and this requires skills and experience. This makes the selection of the appropriate pentesting partner important. Qualysec is the most popular cybersecurity firm that deals with payment aggregators’ compliance in India. Further, we realise the peculiar issues that fintech companies have. Also, our staff has regulatory expertise and technical superiority.

Comprehensive RBI Compliance Solutions

Qualysec has end-to-end services that are tailor-made for the payment aggregators. We initiate comprehensive security tests first, which is in line with RBI guidelines. Second, we determine the vulnerabilities of all payment systems. Third, we offer practical remedial advice. In addition, we provide our services across all areas of compliance.

Our pentesting process is based on international standards such as OWASP, PTES, and NIST. Moreover, we tailor our solution to your own payment system. We also test online and offline payment processing systems. Thus, you get all-inclusive security coverage. In addition, we give unambiguous evidence to submissions to the RBI through our reports.

Why Fintech Companies Choose Qualysec?

The reason why Qualysec has gained the reputation of being the most reliable cybersecurity alliance in India is not that easy to overlook. To start with, we have comprehensive knowledge of regulations in the financial sector. Second, we have certified compliance and ethical hackers. Third, we provide outputs on short deadlines. Also, our client satisfaction rate speaks volumes.

Key advantages of partnering with Qualysec include:

- RBI-Focused Expertise: Specialised knowledge of payment aggregator regulations and requirements

- Certified Professionals: Team holds OSCP, CEH, and other recognised security certifications

- Comprehensive Testing: Coverage of web applications, APIs, mobile apps, and infrastructure

- Fast Turnaround: Complete pentesting reports delivered within agreed timelines

- Actionable Reports: Clear findings with practical remediation steps

- Ongoing Support: Continuous guidance throughout your compliance journey

- Proven Track Record: Successfully helped numerous fintechs achieve RBI compliance

- Strategic Location: Based in India with an understanding of the local regulatory environment

Moreover, we do not simply find problems. Also, we collaborate with your crew to adopt solutions. Hence, you develop long-term security forces. Furthermore, we do not only collaborate on individual tests. We assist with your continuing compliance requirements on an annual basis.

Make a free consultation with Qualysec now to discuss your specific pentesting requirements. Our experts will assess your current security posture and create a customised compliance plan. We will also offer an open schedule and cost system. Accordingly, the December 31, 2025, deadline will be completed with a full security validation.

Get the full list of Top 15 FinTech Cybersecurity Companies to Watch in 2026

Conclusion

The RBI Payment Aggregator Pentesting of Fintech in India is a landmark of digital payments in India. The deadline of December 31, 2025, is approaching very fast. Thus, compliance should become the priority of payment aggregators. In addition to that, total security testing has become a non-negotiable thing. Also, select successful pentesting partners, and they will be successful.

India has a stronger payment ecosystem due to the new regulations. Moreover, they safeguard the consumers and enhance innovation. They also have clear standards of operation. Thus, conformist firms will have competitive advantages. In addition, they will develop a higher customer trust.

Don’t wait until the deadline approaches. Instead, begin your compliance journey today. Contact Qualysec immediately to schedule your RBI-compliant pentesting assessment. Our professionals are on hand to assist you in achieving all expectations with competence. As well, we make sure that your payment systems are secure and fully compliant. Thus, defend your business and defend your customers by taking action.

Frequently Asked Questions (FAQs)

Q1: What is the deadline for RBI payment aggregator pentesting compliance?

The compliance deadline is December 31, 2025. All non-bank payment aggregators should file their authorization applications before this date in order to remain in operation.

Q2: What happens if payment aggregators miss the December 31, 2025, deadline?

Organizations that are not approved by February 28, 2026 Enterslice will have to stop operating. As well, unauthorized operation attracts punishment and even legal action against the firm.

Q3: What is the minimum net worth requirement for payment aggregators?

Payment aggregators require ₹15 crore at the time of application and should have achieved ₹25 crore in any of the three years. This is a condition that makes the operations stable financially and safeguards the interests of customers.

Q4: Why is penetration testing mandatory for payment aggregators under RBI guidelines?

Penetration testing determines security vulnerabilities before cybercriminals can use them. In addition, it ensures that the cybersecurity standards are met and the sensitive financial information is not at risk of breaches.

0 Comments