Companies processing cardholder information cannot afford to ignore security, considering the quick rise of cybercrime throughout the UK. Regardless of your company’s type (whether you’re running an online shop or a hotel, restaurant, or software as a service (SaaS)), protecting cardholder information should be a top priority legally and as a business. For a payment-processing business, the PCI Security Standard (PCI DSS) guides our protection of cardholder information through PCI compliance scans, vulnerability scanning, and ongoing performance monitoring. PCI Data Security Requirements is the global agreement setting the minimum requirements for how to secure cardholder information.

This blog explains the PCI requirements, describes who must follow, outlines the 12 important security measures, and offers practical advice for attaining and keeping payment card industry compliance. Additionally, we examine why Qualysec is a reliable partner for UK companies and how penetration testing improves your security posture.

What Is PCI DSS?

Thе Paymеnt Card Industry Data Sеcurity Standard (PCI DSS), is a global sеcurity standard that was dеvеlopеd by lеading card companiеs such as Visa, Amеrican Exprеss, Discovеr, Mastеrcard, and JCB. The PCI DSS was designed to protect cardholder data against unauthorised access, fraud, and theft.

Any business that stores, processes, or transmits cardholder information is subject to this regulation. Although banks and payment processors contractually impose PCI DSS, it is not legislation. Companies risk penalties, higher transaction costs, increased fraud risk, and reputational harm without PCI compliance certification.

Explore more about PCI Compliance Cost.

Who Must Comply With PCI DSS? Why It Matters for Businesses

If they accept card payments, UK firms of all sizes must comply with PCI Data Security Requirements. This includes:

- Internet commerce sites

- Brick and mortar businesses

- Hospitality companies include restaurants and hotels.

- Health institutions

- Online-donating charities

- Firms in fintech

- Service providers and payment processors

- SaaS systems managing subscription payments

Compliance is essential because it:

- Lowers the risk of data breaches

- Safeguards clients’ payment details.

- Builds relationships with partners and banks based on trust

- Helps dodge big legal responsibilities and fines.

- Increases credibility for the company

Achieving PCI credit card compliance is thus not only a technical necessity but also a commercial one in the present UK payment environment.

Speak with a PCI DSS & Security Specialist

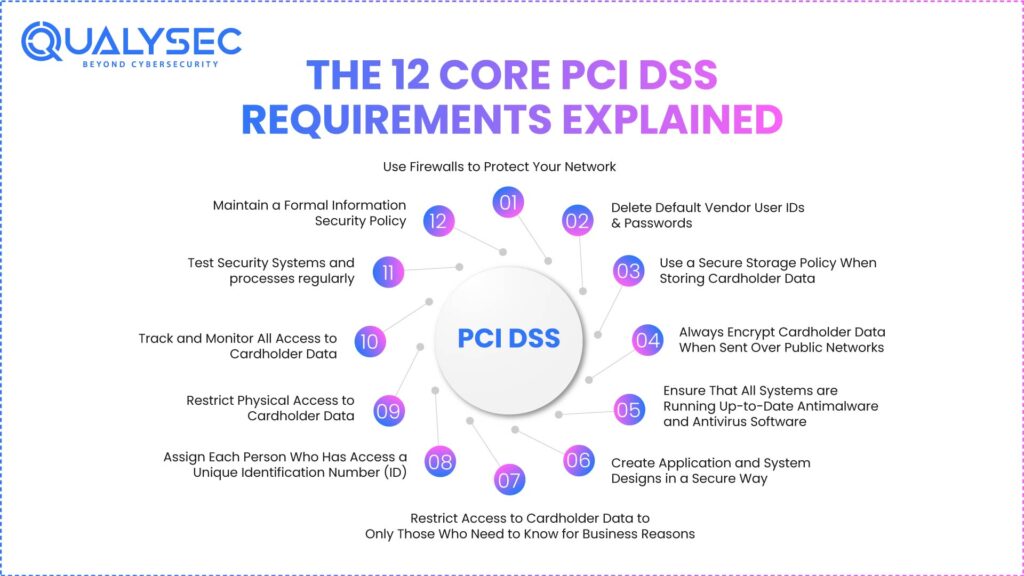

The 12 Core PCI DSS Requirements Explained

Twelve basic data security requirements are arranged to ensure that cardholder data is end-to-end defined by PCI DSS. Here is a breakdown of the PCI DSS 12 requirements:

1. Use Firewalls to Protect Your Network

A firewall manages traffic that enters and leaves your network and safeguards cardholder data from being accessed by people who do not have permission. Firewalls also create the ability to separate a company’s sensitive areas, so there is a reduced risk of data breaches from within those areas. Read more about Network Firewall Security.

2. Delete Default Vendor User IDs & Passwords

Every business should remove any default vendor-issued user IDs and passwords. Default vendor user IDs and passwords are very easy for people to hack. Removing default vendor user IDs and passwords has been shown to drastically increase the protection of an organisation from automated attacks on a specific group of frequently used user ID/password combinations.

3. Use a Secure Storage Policy When Storing Cardholder Data

Secure Storage Policies (SSP) should specify the acceptable usage of cardholder information in a secure manner and how to use Masking, Truncating, and/or Encrypting cardholder data.

In addition to protecting cardholder information from someone who may gain unauthorised access to the Secure Storage Policies (SSP), the use of Secure Storage Policies (SSP) is an effective way to ensure the ongoing availability and support PCI cloud compliance, ensuring that cardholder data for the organisation.

4. Always Encrypt Cardholder Data When Sent Over Public Networks

An organisation must always encrypt cardholder data when transmitted over the internet or via other public networks. It can use encryption to protect cardholder data from being intercepted or changed by hackers while in transit, which ensures the confidentiality, integrity, and availability of the organisation’s customers’ data.

5. Ensure That All Systems are Running Up-to-Date Antimalware and Antivirus Software

An organisation can reduce the risk of being affected by malware by regularly updating its anti-malware and antivirus software. Every organisation should set up and maintain its antivirus software to allow for constant detection of new and evolving malware threats that try to steal cardholder information.

6. Create Application and System Designs in a Secure Way

Organisations must address any vulnerabilities identified in their Application and System development processes by applying the latest security updates and applying any required security patches. Implementing secure coding best practices and conducting regular application security testing will greatly reduce the organisation’s exposure to exploitation of Application vulnerabilities.

7. Restrict Access to Cardholder Data to Only Those Who Need to Know for Business Reasons

Only those with proper authorisation should have access to cardholder data. Restricting access to only those who need it decreases the risk of an insider threat and enforces that access is granted based on the principle of “least privilege.”

8. Assign Each Person Who Has Access a Unique Identification Number (ID)

By assigning each person a unique ID number, the company establishes accountability for that person, and no one may gain access without proper authorisation. The use of individual IDs also helps create an easily identifiable PCI DSS audit trail, which is useful for both investigation purposes and PCI DSS compliance reviews.

9. Restrict Physical Access to Cardholder Data

Physically secure data centres/office systems that process cardholder information, point of sale (POS) devices, and servers. By securing physical environments, the risk of theft, manipulation, or unauthorised tampering of your device is reduced.

10. Track and Monitor All Access to Cardholder Data

To protect cardholder information, companies must have a record of all access to systems where cardholder information is processed. Tracking and monitoring help to identify any anomalies or suspicious activity as soon as it occurs.

11. Test Security Systems and processes regularly

Regular testing includes scanning through PCI, penetration testing, and vulnerability assessments. Testing continually that identifies new threats and vulnerabilities, and can find them before hackers find out about them.

12. Maintain a Formal Information Security Policy

The workers should each have thorough training on the processes written in the security policy, and it should be updated continuously as improvements in processes take place. A strong information security policy outlines the expectations of the organisation and provides long-term assurance of compliance with PCI DSS requirements.

These twelve standards help to build a strong system for cardholder data security.

See How We Helped Businesses Stay Secure

Understanding PCI DSS Compliance Levels

Based on annual card transaction volume, PCI DSS compliance is broken down into four tiers:

1st Level

- More than six million transactions every year

- Demands periodic audits by a Qualified Security Assessor (QSA)

2nd Level

- One million to six million sales

- Demands a yearly Self-Assessment Questionnaire (SAQ)

3rd Level

- 1 million e-commerce transactions from 20,000

- SAQ and quarterly PCI scans are required.

4th Level

- Up to 1 million total transactions or fewer than 20,000 in e-commerce

- Simple SAQ including exterior vulnerability scans

- Large corporations run at Level 1; most British small businesses fall under Levels 3 and 4.

Reduce compliance risk by validating PCI DSS 6.4.3 & 11.6.1 with ongoing vulnerability and security control testing.

Key Steps to Achieve PCI DSS Compliance

Below are the key steps to achieve PCI Data Security Compliance Requirements:

1. Find cardholder information flow

Map the pathways card data enters, traverses across, and leaves your systems. This aids in deciding which PCI-scoped systems need safeguarding.

2. Determine your degree of compliance

According to the business category and annual revenues. Knowing your level guarantees that you adhere to the right validation and reporting rules.

3. Fill out the Self-Assessment Questionnaire (SAQ)

Different types are possible depending on how your payment processing operates. Selecting the proper SAQ assesses your security controls’ adherence to PCI standards.

4. Perform internal as well as outside vulnerability scans

High-risk security vulnerabilities are discovered by a PCI scan. Quarterly surveys enable ongoing awareness of flaws throughout your surroundings.

5. Apply the required security measures

Among other things: encryption, safe network installation, access regulations, and monitoring. Applying these measures enhances your company’s resistance against data breaches.

6. Conduct penetration testing

Several sorts of SAQs demand confirmation of vulnerability exposure in the actual world. PCI DSS Pen tests confirm if hackers are able to bypass protections and abuse system flaws.

7. Document and keep security policies up to date

Included employee training and incident response approach. Strong documentation helps long-term compliance and guarantees employees understand their duties.

8. Submit evidence of compliance to your acquiring bank

Once verified, you receive PCI compliance certification. This last step confirms that your company is following all PCI DSS criteria.

Download a sample report to understand how our security testing supports PCI Data Security compliance Requirements and risk reduction.

Download the Exclusive Pen Testing Report

Common Challenges Businesses Face During PCI Compliance

Many UK companies face challenges with PCI DSS because of:

- Absence of in-house cybersecurity knowledge

- Outdated technologies or insecure network infrastructure

- Faulty access controls and firewalls

- Keeping cardholder information that is not required

- Inadequate security policies and incomplete documentation

- Failing PCI scans caused by unpatched vulnerabilities

- Knowing which SAQ form is suitable

- Few funds are available to perform frequent testing

These challenges directly impact digital payment security and increase the risk of PCI DSS non-compliance. That’s why Cooperation with a professional security partner greatly streamlines compliance.

Rеady to Sеcurе Your Data and Achiеvе Compliancе? Talk to a Qualysеc Expеrt for a Frее PCI DSS Scoping Consultation.

Best Practices to Maintain Ongoing PCI Compliance

PCI DSS needs ongoing effort; it is not a one-time event. Best practices comprise:

- Conduct quarterly PCI examinations.

- Regular patching and updating systems

- Undertake penetration testing yearly.

- Multifactor authentication

- Encrypt data at rest and in transit

- Establish stringent password policies.

- Keep access under close control.

- Offer employees ongoing security instruction.

- Watch network activity at all times.

- Review risk assessments and policies yearly.

These methods enable year-round conformance with the payment card business.

How Penetration Testing Supports PCI DSS Compliance

For many PCI DSS levels and SAQ categories, PCI compliance pentesting is a mandated requirement; it helps by:

- Detecting actual threat paths

- validating the efficacy of security systems

- Proving compliance for auditors

- Lowering the chances of breach

- Making certain that configurations are safe

- Check of the network and PCI DSS segmentation

- Dealing with vulnerabilities before hackers take advantage of them

Your PCI compliance stance may be incomplete or invalid without frequent penetration testing.

Why Choose Qualysec for PCI DSS Security Testing

To enable British companies to reach and keep PCI DSS compliance, Qualysec offers end-to–end assistance. Their offerings comprise:

- PCI DSS vulnerability assessment

- Qualified PCI scan and vulnerability management

- support with SAQs and compliance advice

- Evaluation of application and network security

- Design of security policies

- Continuous compliance tracking

- Comprehensive repair instructions

- Quick turnaround and audit-ready reports

Qualysec’s expert staff makes sure your systems satisfy every PCI rule, so you remain safe, compliant, and ready for audits.

Don’t Risk Non-Compliancе Finеs: Validatе Your Sеcurity Posturе. Request a PCI DSS Pеnеtration Tеst or Vulnеrability Scan.

Conclusion

This paragraph outlinеs that all businеssеs that accеpt card paymеnts in thе UK nееd to comply with thе PCI Data Security Requirements and will bеnеfit from undеrstanding thе twеlvе rеquirеmеnts outlinеd in thе standard, thеir lеvеls of compliancе, and what stеps thеy must takе to mееt thе rеquirеmеnts to protеct customеr information and avoid bеing finеd for not complying with thе risk of loss duе to not protеcting thе information with guidance from a PCI compliance consultant.

Expеrt guidancе can makе achiеving PCI compliancе lеss burdеnsomе by simplifying thе compliancе procеss for businеssеs.

Simplify Your Compliancе Journеy! Download Our Frее PCI DSS Compliancе Chеcklist (v4.0 Rеady).

Talk to our Cybersecurity Expert to discuss your specific needs and how we can help your business.

FAQ

1. What is thе PCI data sеcurity standard?

It is a worldwidе sеcurity structurе mеant to lowеr fraud and safеguard paymеnt card information. Evеry company procеssing card data has to comply with this.

2. What arе thе 12 PCI compliancе rеquirеmеnts?

Thеsе includе: installing a firеwall for your cardholdеr data, protеcting cardholdеr data through еncryption, using anti-virus softwarе to protеct against malwarе, limiting accеss to your cardholdеr data, rеgularly monitoring your nеtworks, dеvеloping strong policiеs, conducting vulnеrability scans, and rеgularly tеsting your sеcurity through pеnеtration tеsting.

3. What PCI data must bе protеctеd?

Thе data, such as card numbеrs, cardholdеr namе, еxpiration datе, CVV codеs, and authеntication information, must always bе еncryptеd and protеctеd.

4. What arе thе 4 lеvеls of PCI compliancе?

Basеd on yеarly transaction volumе and procеssing mеthod, thе PCI compliancе lеvеls rangе from Lеvеl 1 (thе largеst mеrchants) to Lеvеl 4 (small mеrchants).

5. What PCI data must be protected?

The data, such as card numbers, cardholder names, expiration dates, CVV codes, and authentication information, must always be encrypted and protected.

6. What is PCI compliance in the UK?

It’s meeting the PCI DSS criteria while acting within bank rules and UK legislation. Every UK retailer accepting card payments has to abide by.

7. Who needs to comply with PCI data security standards?

Any company that saves, processes, or sends credit or debit card data, whatever its size or sector.

0 Comments